THE Government says that Chancellor of the Exchequer delivered a Spring Statement today (Wednesday) that puts billions of pounds back into the pockets of hard-working people – unveiling a new Tax Plan to ease the rising cost of living and to deliver the biggest cut to personal taxes in a quarter of a century.

A Treasury spokesperson said: “Rishi Sunak announced that National Insurance starting thresholds will rise to £12,570 from July, meaning hard-working people across the UK will keep more of what they earn before they start paying personal taxes.

“The cut, worth over £6 billion, will benefit almost 30 million working people with a typical employee saving over £330 in the year from July. This means the UK now has some of the most generous tax thresholds in the world.

“Mr Sunak also announced that fuel duty for petrol and diesel will be cut by 5p per litre from 6pm tonight (March 23) to help drivers across the UK with rising costs – a tax cut worth £2.4 billion. This is the biggest cut ever on all fuel duty rates and means a one-car family will now save on average £100.

“To let people keep more of what they earn, the basic rate of income tax will also be cut by 1p in the pound in 2024, when the OBR expect inflation to be back under control, debt falling sustainably and the economy growing. The cut is worth £5 billion for workers, savers and pensioners and will be the first cut to the basic rate in 16 years.”

The Chancellor also set out a series of measures to help businesses boost investment, innovation, and growth – including a £1,000 increase to Employment Allowance to benefit around half a million smaller firms.

Delivering the Spring Statement, Chancellor Rishi Sunak said: “This statement puts billions back into the pockets of people across the UK and delivers the biggest net cut to personal taxes in over a quarter of a century.

“Like our actions against Russia, I have been able to do this because of our strong economy and the difficult but responsible decisions I have had to make to rebuild our finances following the pandemic.

“Cutting taxes means people have immediate help with the rising cost of living, businesses have better conditions to invest and grow tomorrow, and people keep more of what they earn for years to come.”

Delivering the statement, the Chancellor made clear that our sanctions against Russia will not be cost-free for people at home, and that Putin’s invasion presents a risk to the UK’s economic recovery – as it does to countries all around the world.

However, announcing the further measures to help people deal with rising costs, he said the extra support could only be provided because of the UK’s strong economy and the tough but responsible decisions taken to rebuild our fiscal resilience.

The immediate help for people with the cost of living and support for businesses comes as part of a wider Tax Plan announced by the Chancellor that will also create better conditions for growth and will share proceeds from growth more fairly – ensuring people can keep more of what they earn.

- Help with the cost of living: The Chancellor said that global supply chain issues following the pandemic, as well as Russia’s invasion of Ukraine, are driving up the cost of living for families across the UK.

To combat this, he announced that from 6pm this evening (March 23) fuel duty will be cut by 5p per litre for 12 months – worth £2.4 billion for hard-working families across the UK.

To ease cost of living pressures for almost 30 million employees, the Chancellor announced that from July 2022, National Insurance thresholds will rise to £12,570 to align with the income tax personal allowance. This simplification means that, from July, 70% of workers who pay NICs will pay less of it, even after accounting for the Health and Social Care Levy. Of those who benefit from the threshold increase, 2.2 million people will be taken out of paying NICs altogether.

To ensure more people can keep more of what they earn for years to come, the Chancellor also announced plans to cut the basic rate of income tax from 20p to 19p from 2024. The historic £5 billion tax cut for workers, pensioners and savers will be worth £175 on average for 30 million people and will be the first cut to the basic rate in 16 years. This will be delivered in a responsible and affordable way, while continuing to meet our fiscal rules.

Mr Sunak also announced that there will be an extra £500 million for the Household Support Fund, which doubles its total amount to £1 billion to support the most vulnerable families with their essentials over the coming months. The Chancellor also reduced the VAT on energy-saving materials such as solar panels, heating pumps and roof insulation from 5% to zero for five years, helping families become more energy-efficient.

This cost of living support comes on top of the measures that the Chancellor has already announced over the recent months to support families. This includes a £9 billion energy bill rebate package, worth up to £350 each for around 28 million households, an increase to the National Living Wage, worth £1,000 for full time workers, and a cut to the Universal Credit taper, worth £1,000 for two million families.

- Boosting Investment, Innovation and Growth: To lift growth and productivity among UK businesses, Mr Sunak set out plans to boost private sector investment and innovation and bring in a new culture of enterprise.

He increased the Employment Allowance – a relief which allows smaller businesses to reduce their employers National Insurance contributions bills each year – from £4,000 to £5,000. The cut is worth up to £1,000 for half a million smaller businesses and starts in two weeks’ time, on April 6. As a result, 50,000 of these businesses will be taken out of paying NICs and the Health and Social Care Levy, taking the total number of firms not paying NICs and the Levy to 670,000.

The Chancellor also announced two new business rates reliefs will be brought forward by a year to come into effect in April 2022. There will be no business rates due on a range of green technology used to decarbonise buildings, including solar panels and batteries, whilst eligible heat networks will also receive 100% relief. Together these will save businesses more than £200 million over the next five years.

Ahead of the end of the super-deduction, the Government will work with businesses and other stakeholders to consider cuts and reforms to best support future investment. And with UK employers spending just half the European average on training their employees, the Chancellor said he will examine how the tax system – including the operation of the Apprenticeship Levy – can be used to encourage employers to invest in adult training.

The Chancellor committed to improving R&D reliefs too. UK business R&D investment is less than half of the OECD’s average as a percentage of GDP, so R&D tax reliefs will be reformed to deliver better value for money for the taxpayer while being more generous where they can make the most difference. The scope of reliefs will also be expanded to cover data, cloud computing and pure maths.

The support for SMEs comes on top of 50% business rates relief for eligible retail, hospitality, and leisure properties, also coming in this April and worth £1.7 billion for small businesses. The Help to Grow Management and Digital schemes, worth thousands of pounds per business, and the £1 million Annual Investment Allowance are also available to continue supporting UK businesses.

- Further announcements: The Spring Statement also confirms that:

• A new Efficiency and Value for Money Committee will be set up to cut £5.5 billion worth of cross-Whitehall waste – with savings to be used to fund public services.

• £50 million new funding will be provided to create a Public Sector Fraud Authority to hold departments to account for their counter-fraud performance and to help them identify, seize and recover fraudsters money.

• Local residents across the UK will benefit from a fresh set of infrastructure projects as we open the second round of the £4.8 billion Levelling Up Fund. It will continue to focus on regeneration, transport and cultural investments.

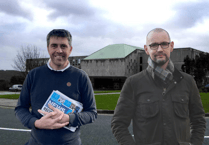

Commenting on the Chancellor’s Spring Statement from a Cornwall perspective, St Austell and Newquay MP Steve Double said: “Even as we come out of the pandemic, its after-effects will continue to be felt for many years, and along with the continuing war in Ukraine, these are very difficult times for us all.

“That is why I am pleased to see our Chancellor again act quicky and proportionately to help combat the rise of the cost of living. These measures help workers and employers through this difficult time, while the increase of the household support fund will ensure that councils have funding to ensure the most vulnerable do not get left behind.”

However, Leader of Cornwall Lib Dem Council Group Cllr Edwina Hannaford – Cornwall Councillor for Looe West, Lansallos, Lanteglos and Pelynt – said: "The Conservatives have shown yet again that they are the party of broken promises. They have broken their promise not to break the triple lock on pensions.

"Cornwall Liberal Democrats are calling on the Government to row back on their broken promise and guarantee a fairer increase to the state pension.

"Lib Dems are also calling for a doubling and expansion to the Warm Home Discount, giving 63,652 households in Cornwall £300 each off their heating bills this year and a doubling of the Winter Fuel Allowance, to the benefit of 18,020 households.

"And to add insult to injury, MPs have benefited from a £2,000 pay increase. It’s one rule for them and another for the rest of us.”

The Taxpayers Alliance, meanwhile, described the Statement as "tinkering around the edges". John O’Connell, chief executive of the TaxPayers’ Alliance, said: “Taxpayers suffering through a cost of living crisis will welcome wins on fuel duty and income taxes. Soaring inflation has given the Chancellor extra wiggle room, but this tax plan needs to come alongside an efficiency drive to eradicate waste and tackle the colossal cost of COVID.

“Rishi must get a grip on spending if he wants to restore balance to the public finances while boosting growth and letting taxpayers keep more of their own money.”

Responding to a promised 1p cut to income tax following existing planned tax rises, Mr O’Connell added: “Though a cut in income tax is welcome, in reality the Treasury is taking with one hand to give away with the other.

“Cutting income tax down the line will be easily offset by the upcoming National Insurance hike and freezing income tax thresholds, leaving taxpayers out of pocket overall. If the Government wants to give taxpayers and businesses a respite from rises, they’d do well to simply scrap the health and social care levy.”

He added: "The alignment of income tax and National Insurance is a welcome step to simplifying the tax system. The Chancellor should take this chance to combine the two into a single income tax and offer a really radical reform of the tax code.”

Also responding to the Spring Statement, Cllr Shaun Davies, Chair of the Local Government Association’s Resources Board, said: “This year will be the toughest for more than half a century, particularly for those on lower incomes, so it is good that the Chancellor is taking steps with financial measures which will help mitigate against some of those pressures for struggling households.

“As the impact of cost-of-living concerns grow, the mainstream benefits system will need to provide the first line of support for people so that councils and local partners can concentrate their limited resources on helping those who need tailored and additional help.

"We are pleased the Government is providing a further £500 million for councils to continue to provide targeted local welfare support to low-income households facing financial hardship in their communities. Councils will need maximum flexibility and quick details on allocations, so they can ensure this funding reaches those in need and can be used to prevent families from reaching crisis point in the first place.

“The increase in short-term Government funding through the Household Support Fund is a positive step but cannot on its own address underlying cost-of-living pressures, or to help people to make the most of their money and strengthen financial resilience.

"With many households likely to be economically vulnerable for some time to come, councils also want to work with Government on an effective long-term solution to preventing poverty and disadvantage that moves away from providing crisis support towards improving life chances.

“Local government itself continues to face significant financial challenges. Inflationary pressures, our own wage bill and energy price rises, as well as the ongoing cost of dealing with and recovering from the COVID-19 pandemic, look increasingly likely to make 2022/23 significantly more challenging for councils than initially estimated when the Government made its funding decisions as part of the Spending Review. We remain clear that this continued pressure cannot be met by council tax rises alone.

“It is crucial that local services have a long-term, sustainable future with certainty for councils over their funding. Councils still need urgent for clarity from the Government on which local government funding reforms will happen and when, and what the impact of any changes would be. The continued model of relying on council tax raising powers to increase councils’ core spending power is not sustainable or fair on local taxpayers or those who reply on council services.”